Photo by Sasun Bughdaryan on Unsplash

You found your dream home here in sunny Hilton Head Island, South Carolina; the price has been set, your loan has been approved, and you might be eager to start planning the next step—moving in. However, the deal isn’t over yet. You still need to wrap up things before you can finally get that key!

During the closing, when the buyer sees the closing paperwork, they will realize there are more costs in buying a house than just the negotiated sale price, and this is what we call “closing costs.”

Read on to learn more about closing costs and ways to minimize these!

What Are Closing Costs?

Photo by Colin Watts on Unsplash

Closing costs include all the fees buyers must pay upfront to various third parties, like real estate agents, lenders, appraisers, insurance companies, and tax authorities, including administrative and legal costs. These costs are included in the loan estimate and closing statement paperwork provided by the lender.

Why Are Closing Costs Important?

Photo by Alexander Mils on Unsplash

Closing costs in South Carolina are essential to complete the real estate transaction and transfer home ownership from the seller to the buyer. To fully grasp the importance of closing costs, an excellent example is the recording fee that local or state governments impose on real estate sales to make them public records. It is vital to document the sale to avoid future legal liabilities.

That being said, knowing about closing costs in South Carolina before entering a real estate transaction is crucial if you are planning to buy or sell a home in Hilton Head Island, SC. It will assist sellers in determining the ideal price for their property without reducing their profit margins. Knowing what closing costs are involved can also help homebuyers estimate their finances.

Who Pays Closing Costs in Hilton Head Island, SC?

Photo by Towfiqu barbhuiya on Unsplash

Like in other states, buyers and sellers in Hilton Head Island, SC pay a certain amount for closing costs.

Obtaining a mortgage and conducting due research on the property are two things that buyers generally pay as closing fees. In South Carolina, the average closing costs for buyers is 2% of the sales price and from 6% to 10% for sellers.

A typical home in the state currently costs $299,965. Thus, buyers may have to pay closing costs ranging from $5,999 to $17,997.

Here are other closing costs buyers may have to pay in Hilton Head Island when purchasing homes:

Application Fee

It is the fee charged upfront by lenders when a buyer submits their loan application, although not all lenders charge an application fee.

In Hilton Head Island, SC, mortgage lenders typically charge an application fee of 0.5% to 1% of the loan amount. Application fees are not refundable. Therefore, even if you have a rejected loan application, you still won’t get your money back.

Appraisal Fee

The buyer will pay for the lender-required appraisal to assess the property’s market value before granting the loan amount. It helps lenders to determine the loan amount and the loan-to-value ratio. The appraiser receives payment regardless of whether the mortgage is approved or not.

If the buyer requires a mortgage, the real estate agent may indicate an appraisal contingency clause in the contract, allowing the buyer to walk away with their initial deposit if the appraised home value does not match the agreed sale price.

Loan Origination Fee

The mortgage lender will charge an upfront loan origination fee to complete the transaction after approving the loan. This fee will be disclosed to you by the lender before the loan is processed.

Attorney Fee

The state of South Carolina requires a real estate lawyer to be present at the closing. Joint land ownership, personal loans from family or friends, and easements on the property are a few situations when hiring a real estate lawyer can be helpful.

On behalf of the lender, real estate attorneys prepare and review the purchase agreement and transfer of title while providing negotiation advice.

HOA Transfer Fee South Carolina

The homeownership must be transferred to the buyer in the HOA records during the closing if the seller is a Hilton Head Island’s Homeowner Association member.

Homeowner's Insurance

The majority of lenders require seeing proof of homeowner insurance before financing a loan for their protection.

Private Mortgage Insurance

Buyers who choose a conventional loan and put down less than 20% will be required to purchase private mortgage insurance (PMI), per the lender’s requirements.

Survey Fee

Survey costs are payments to a professional surveyor who draws the property highlighting its boundaries, easements, improvements, and physical factors like the elevation of the home, among other things.

In South Carolina, including Hilton Head Island, land surveys are not required, but lenders and title companies sometimes need the report to grant lender’s title insurance.

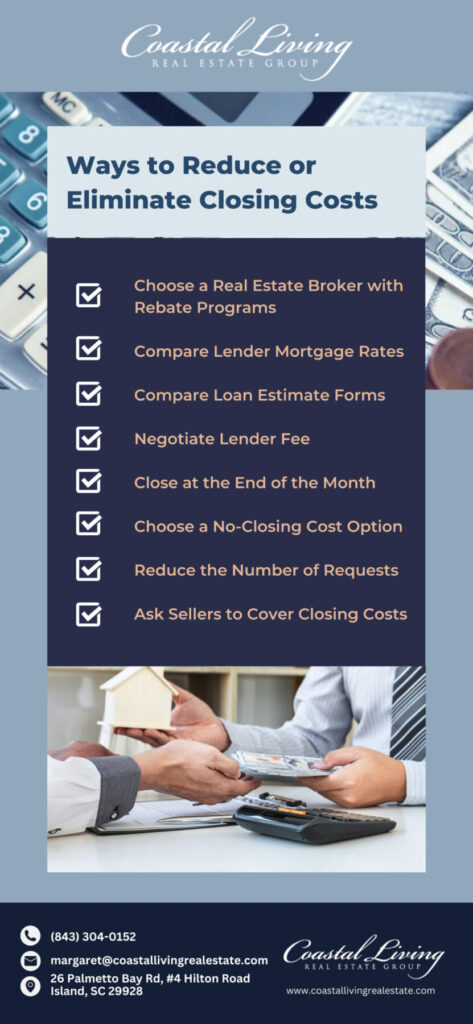

Ways to Reduce or Eliminate Closing Costs

Photo by Andre Taissin on Unsplash

South Carolina closing costs are some of the highest in the United States, and Hilton Head Island is no exception.

For context, the median home price in South Carolina is $353,200. Hence, the closing costs for the seller in South Carolina typically range from $28,256 to $35,320, while closing costs for the buyer can range between $17,660 and $21,192.

With all these fees, you may wonder if there are any ways to lower your closing costs in South Carolina. Of course, there are! Here are some of them.

Choose a Real Estate Broker with Rebate Programs

There are real estate brokers who provide incentives, such as rebates, to help reduce closing expenses or buy down mortgage interest.

Compare Lender Mortgage Rates

Compare lenders to select the lender offering the best mortgage rates and benefits. Moreover, you can negotiate the mortgage rate with your preferred bank. Additionally, if you have a cheaper rate offer from another lender, you can share it with your preferred bank and ask if they can match or beat it.

Compare Loan Estimate Forms

Lenders must provide you with a loan estimate form within three days of receiving your loan application. All charges, including the loan balance, interest rate, and monthly payments, are listed in the form. The “services you can shop for” section also allows you to compare different lenders’ recommended vendors. Nevertheless, you can select vendors on your own.

However, keep in mind that selecting vendors on your own involves the risk of higher closing costs if they raise their prices before closing. Vendors provided by the lender may not increase or decrease their fees from the original quote by more than 10%.

Negotiate Lender Fee

You can request the lender to waive the origination and underwriting fee or negotiate a lower cost.

Close at the End of the Month

You can reduce the prepaid daily interest charges in South Carolina by closing at the end of the month. This is how you can calculate the prepaid everyday interest savings:

- First, get the annual interest expense by multiplying the loan amount by the interest rate. For instance, if the rate is 5%, it will be the loan amount multiplied by .05.

- Then divide the annual interest expense by 360 to get the daily interest charge.

- The total computed amount in the previous step is then multiplied by the number of days left in the month plus the first day of the following month.

Choose a No-Closing Cost Option

By including closing fees in the mortgage, you can avoid paying them when closing. But lenders who offer this no-closing-cost option demand a higher interest rate in exchange.

Reduce the Number of Requests

It would help if you made as few requests as possible so that the seller is more willing to fund some of the closing costs. If there are a lot of hassles, the seller may doubt your sincerity and decide to back out.

Ask Sellers to Cover Closing Costs

Depending on the market, you can ask the seller to grant credits toward closing costs or to pay a portion of the closing costs for South Carolina purchasers.

Closing Cost Calculator Hilton Head Island, SC

Photo by Recha Oktaviani on Unsplash

For both buyer and seller, it is essential to calculate the closing costs while selling a house or buying one in any gorgeous Hilton Head Island neighborhood. The projected closing costs assist buyers in determining how much they will have to spend in addition to the agreed-upon value of the home while offering sellers an idea of the amount of equity they will have in their home after the sale.

There are many available closing cost calculators in South Carolina that you will find online that you can use. However, remember that these closing cost calculators are estimates only, and the actual fees and expenses may change depending on various factors, including the exact closing date.

Conclusion

Photo by Towfiqu barbhuiya on Unsplash

Closing costs in Hilton Head Island, South Carolina are required fees buyers and sellers must pay, where the buyer usually pays about 2% to 5% while the seller shoulders at least 6% to 10%.

Closing costs can be high and must be paid upfront to various third-party stakeholders involved in the transaction. However, there are ways you can reduce or eliminate the amount you need to pay, such as negotiating the fee with the lender and comparing lenders to find the best mortgage rates offered to name a few.

Do you have further questions about Hilton Head Island, SC closing costs? Are you interested in buying homes in South Carolina? Whether you need an answer or assistance, you can connect with me by calling (843) 304-0152 or getting in touch through my social media accounts below.

Photo by Towfiqu barbhuiya on Unsplash

Frequently Asked Questions

What are the standard closing costs in Hilton Head Island, SC?

Closing costs for sellers in Hilton Head Island, SC, are estimated to range from 6% to 10% of the home’s agreement value while 2% to 5% of the home’s purchase price for buyers.

Are any closing costs specific to Hilton Head Island, SC?

Closing cost is similar to any other state, where it changes depending on your local market and the specifics of your loan and lender requirements. However, like in other parts of South Carolina, attorneys usually close costs transactions in Hilton Head Island.

What are the most common closing costs in Hilton Head Island, SC?

For the seller, the closing cost usually includes the realtor, recording, and escrow fees. Meanwhile, for buyers, it commonly involves fees for loan origination, impound account, and the appraisal fee.

How much should you expect to pay in attorney fees?

Read the fees and costs listed in your loan estimate, and ask the lender about each payment to see if it’s necessary or can be waived or reduced. It will also be helpful to compare offers between different lenders.

How can a buyer ensure they are getting the best deal on their closing costs?

To get the best deal on closing costs, you can negotiate it with your lender. But note that not every fee is negotiable, so understand what is negotiable and what is not.

![22 Things to Know BEFORE Moving to Hilton Head Island, SC [2023 Guide] Featured Image](https://coastallivingrealestate.com/wp-content/uploads/2023/01/22-Things-to-Know-BEFORE-Moving-to-Hilton-Head-Island-SC-2023-Guide-Featured-Image-300x196.jpg)